Principia Fiscalis

Victor Hugo once wrote that fashions have done more harm than revolutions. In public matters today, nothing is so fashionable as ignoring fiscal policy. Under the cloud of a pandemic, its disappearance from the discourse is understandable, but it’s been fading for a long time. As a campaign issue, it feels as quaint and outdated as bimetallism. This is unfortunate because, over the long term, fiscal policy determines the viability of the U.S. as a sovereign nation.

If there is a fundamental principle of fiscal policy, it is this: A sovereign country cannot remain fiscally viable if its long-term public spending growth is greater than its economic growth.

This principle is neither policy position nor economic doctrine. Philosophy doesn’t enter into it. It’s really no more than arithmetic. Government outlays must be drawn from the underlying economy, either by taxes or borrowing (or money-printing, which can be understood as another form of tax), and, over the long term, it is impossible for the former to outgrow the latter.

For example, if the economy is growing at 1%, we cannot expect government spending to sustain a 3% growth indefinitely—equivalent to expecting public outlays to exceed the entire underlying economy someday. Again, this isn't a policy position: the correspondence between growth of spending and growth of GDP is more fundamental than any particular tax scheme, and more fundamental than the question of how sensitive GDP is to taxes or spending (though more on that below). In fact, the statement of principle above makes no claims at all about cause and effect between tax policy, spending policy, and GDP. It merely says that an unfavorable long-term imbalance in growth rates will lead to unbounded deficits, which no economy, no nation, can long survive.

In the U.S., the growth rates for federal spending and GDP have been underwater for much of the past two decades, and the country has been poorly positioned to respond to fiscal shocks. The 2020 pandemic and our fiscal response have of course accelerated the trend.

Such a fiscal situation can’t continue forever so, as Herbert Stein taught, it won’t. History is quite consistent on this point: continually escalating debt brings sovereign countries to crisis.

How Bad Is It?

Let’s look at the past 35 years. It seems to me this is the modern era of fiscal policy, over which we’ve become inured to increasing levels of deficit and debt.

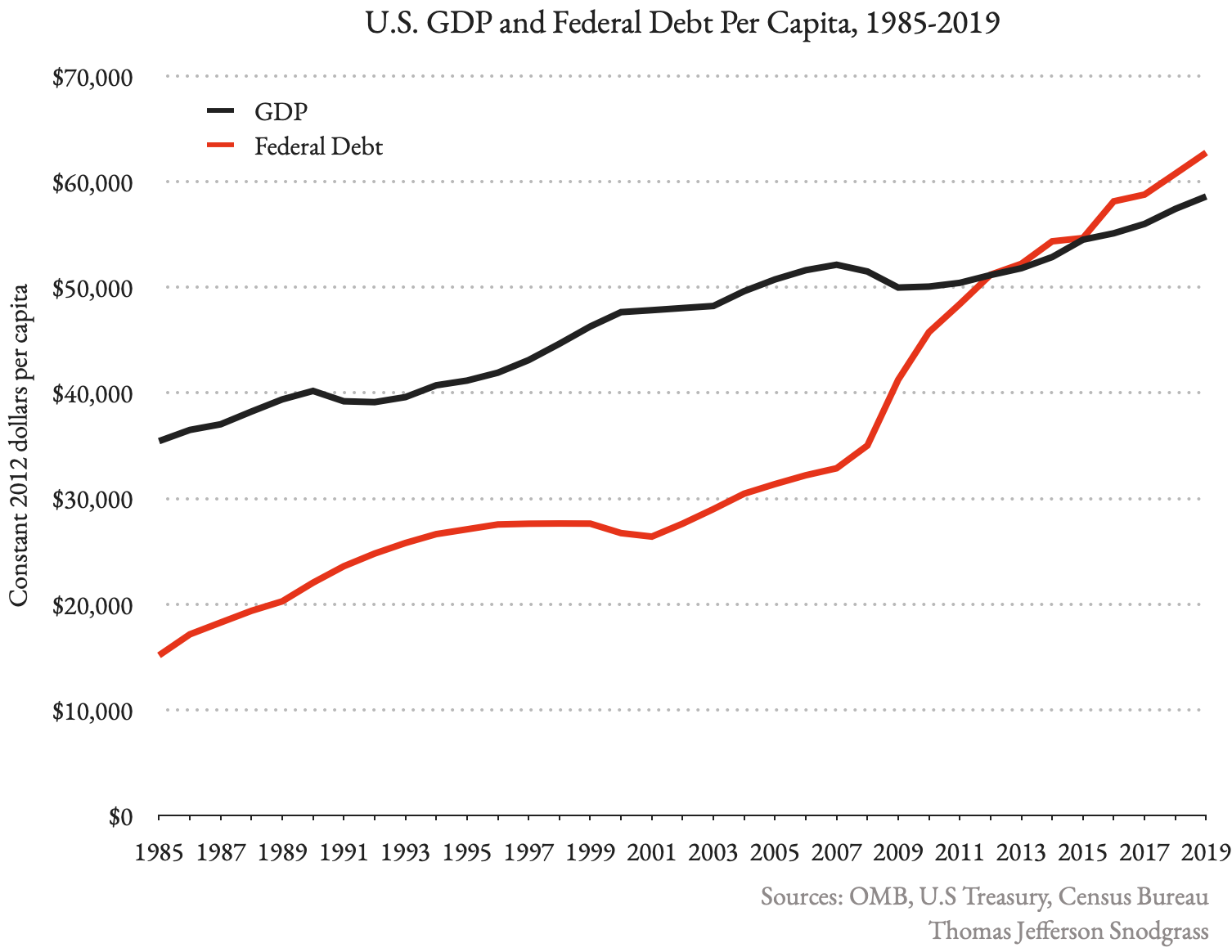

Over this period, the accumulated federal debt has grown from about $2 trillion to $22 trillionAnd the pandemic year of 2020 will add trillions.—about $63,000 for each person in the U.S. The underlying economy has grown too, but only half as fast as the debt. And the trend has accelerated over the past decade.

Is this a problem? Well, first, the debt has to be serviced, and accelerating debt means accelerated interest payments that have to be budgeted each year, drawing resources from other national priorities. Should interest rates increase from their historically low levels, and debt continue to climb, it’s not a stretch to envision interest on the debt dominating the federal budget—more than defense, Medicare, or Social Security. A decade ago Ben Bernanke said, “… given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

And there’s a second problem—debt is far easier to incur than to discharge, and it’s far easier to propose solutions than to implement them. Yet each new year of deficit spending ratchets up the debt and makes the problem harder.

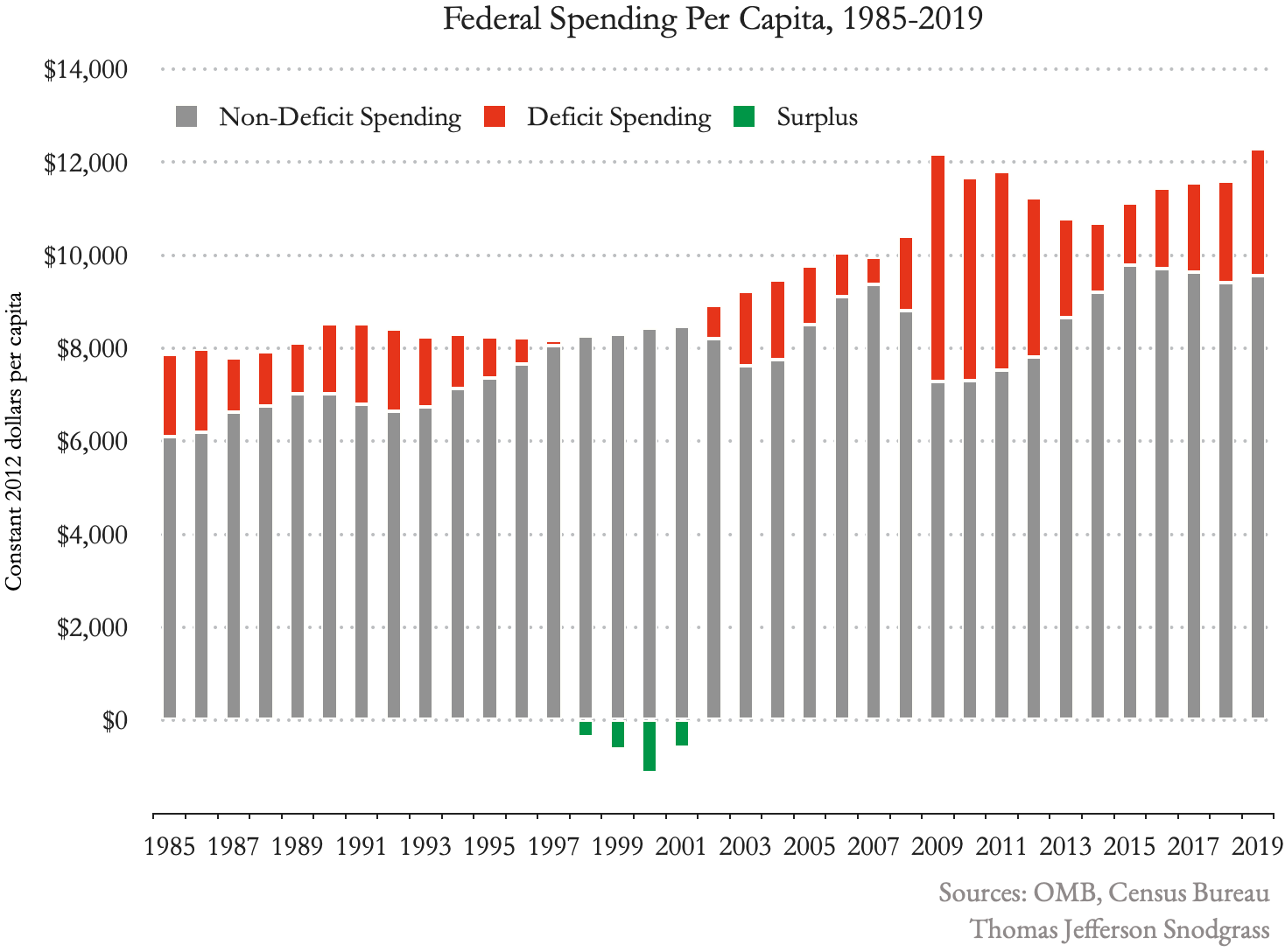

Here we have federal spending over the period of interest, with the deficit and non-deficit components separated. We can see the brief period of budget surplus around 2000; the effects on receipts of income tax cuts around 2001 and 2017, and FICA payroll tax reduction around 2010; and the drop in tax receipts and adoption of stimulus spending in the wake of the 2008 financial crisis.

Two features are worth pointing out. First, there is the persistent yearly gap between tax receipts and spending—the deficit—which is on a worsening trend line.

The second feature is more subtle: taking the above charts together, we can see correspondences between the growth rates of federal spending and GDP. Note for example the deceleration of federal spending in the late 1990s paralleled with the acceleration of GDP in the same time frame, and the dramatic increase of tax receipts (i.e., non-deficit spending). While such correlations are unsurprising, a closer analysis, below, can tease out some overlooked details. But first a detour into federal spending growth.

Where Does the Money Go?

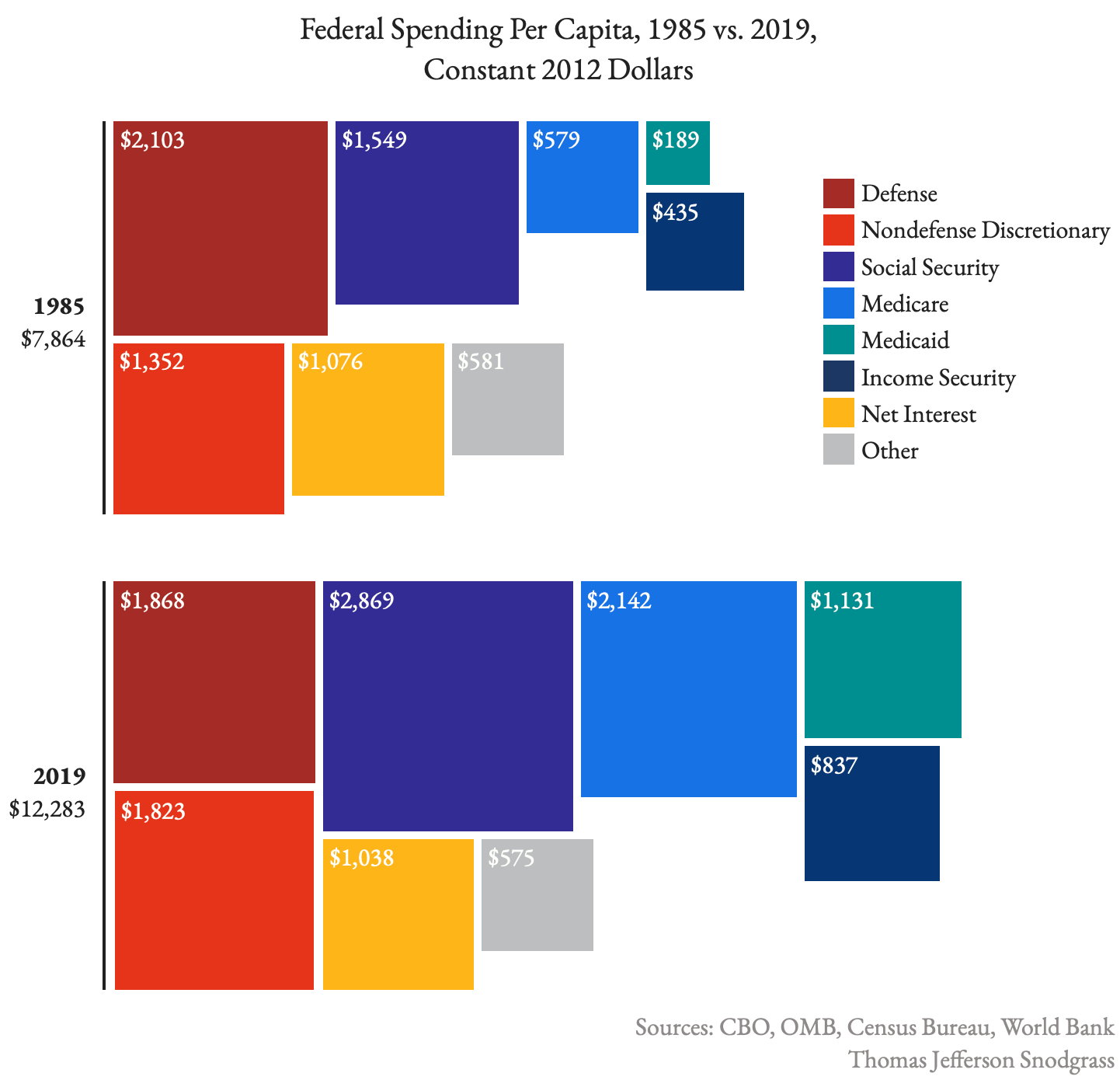

If we break up spending by category, we can see that real per-capita growth in federal spending has been dominated by entitlements and social programs. Politicians who ignore this fact seem to be rewarded, while attempts to call attention to it, like the Simpson-Bowles Commission under President Obama, are dropped into the nearest memory hole. In any case, it’s clear that any proposal to address our fiscal ills, should we ever engage seriously, will have to deal with this reality.

What Do the Data Say?

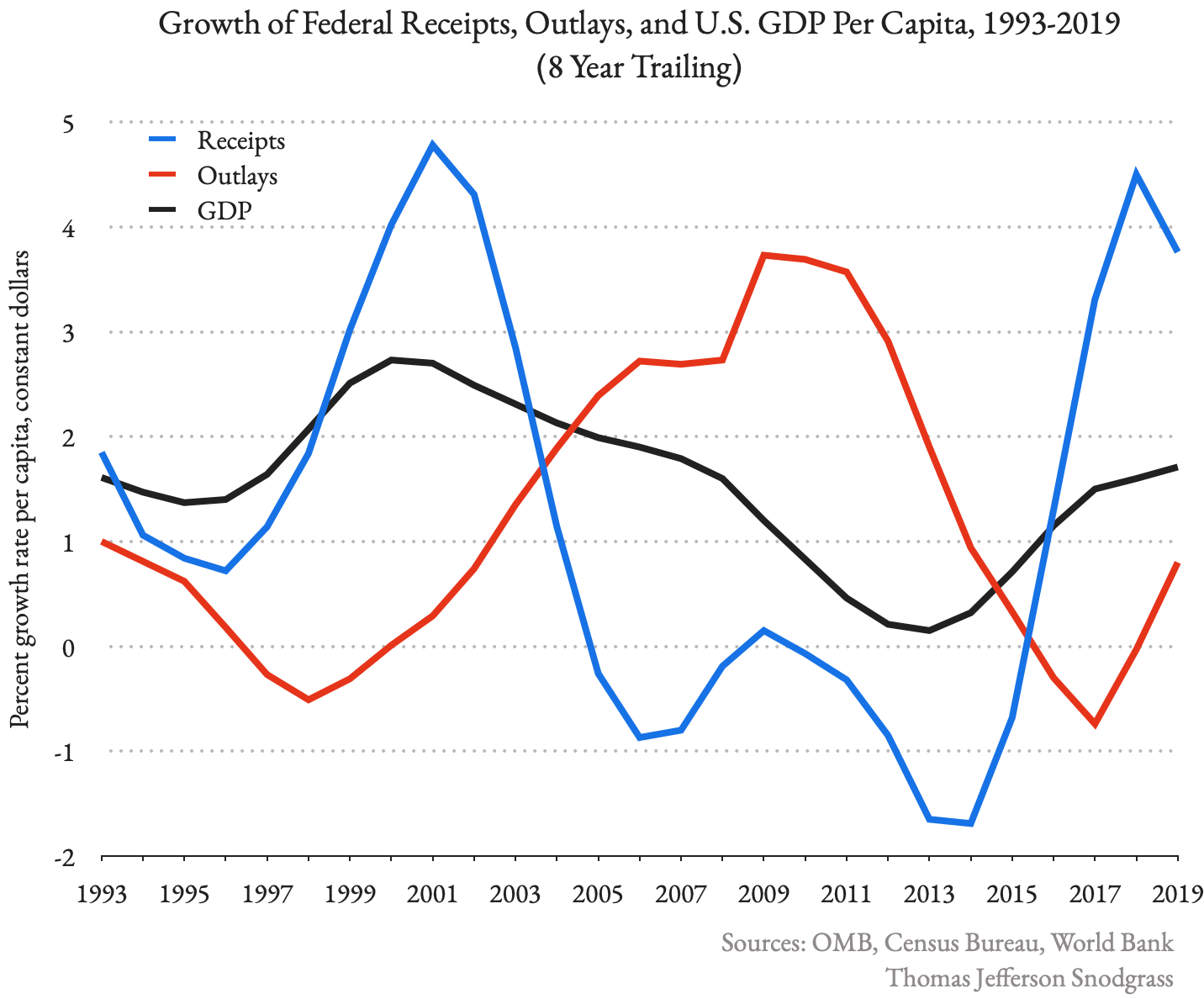

Here I’ve plotted the effective real per-capita annual growth rates for GDP and federal spending and receipts over trailing eight-year periods. The first data point, for 1993, captures the real annual growth rate for the period 1985-1993, when spending growth per capita was about 1%, and GDP growth per capita was about 1.6%. The 2001 point captures the Clinton era, 2009 the Bush era, etc.

The eight-year averaging periods, what we might call average growth curves, hopefully clarify the longer-term trends.

Nobelist Robert Lucas has pointed out"The History and Future of Economic Growth," Robert E. Lucas, Jr.; Chapter 3 of The 4% Solution, 2012. This fascinating essay points out that 2% real per-capita growth seems to be a stable rate to which all mature market-based economies converge. Exceptions occur for immature economies catching up to mature ones, or devastated economies recovering from war. that the U.S. GDP has grown at a remarkably stable near-2% per capita since 1870, fluctuating significantly only during the Great Depression and World War II. Most remarkable is the economy’s return to the same trend line time and again, after recession, depression, and war. Yet this resilience is not guaranteed, and the past two decades call into question its durability in the U.S. In particular, average GDP growth dropped below 2% around 2005, down to nearly zero in 2013, and recovering to only 1% in 2016. While much of this is attributable to the 2008 financial crisis, growth has now been below the 2% mark for a duration equal to the Depression and WWII combined; it’s reasonable to ask if something fundamental has changed.

That’s a question without a secure answer, but the figure above exhibits four striking features that are suggestive and, conjecturally, prescriptive. All three time functions share a period of about a quarter century. We can see significant periods in which rates of growth are increasing and declining for each parameter. But more than that, the periodicity is evidence of some degree of coupling between them.Of course, the common periodicity could be a meaningless coincidence, and other effects may well be driving the observed behavior. All that said, it seems to me that the most reasonable conjecture is that these three parameters are causally linked, at least in part.

First, GDP growth is inversely correlated with spending growth; in particular, spending deceleration in the latter Clinton years corresponded to accelerating GDP, and the converse starts around 2008. This observation is consistent with Milton Friedman’s assertion that each dollar spent by the government is a dollar shifted from more productive investment to less productive investment.

Second, growth in tax receipts is positively correlated with GDP growth. In fact, each point in the rate of GDP growth or decline corresponds to a nearly two point change in the rate of receipts. This effect was most dramatically demonstrated in 1998-2001, when spending deceleration preceded four years of surplus—a remarkable situation which could have been sustained but was not.In January 2001, the CBO's baseline projections showed a cumulative surplus of $5.6 trillion for the 2002–2011 period. The reality was a cumulative deficit of $6.1 trillion—a swing of $11.7 trillion from the January 2001 projections. It’s been wryly called the biggest miss in history. Subsequently, as the rate of GDP growth fell below 2%, the rate of receipt growth became negative.

Third, change in spending growth precedes changes in GDP and tax receipts growth. This is evidence (though, it must be said, not proof) of causality, not just correlation, with federal spending as a driving function. The implication is that if the growth in federal spending can be moderated, and sustained, GDP may revert to its long-term 2% growth rate.

Fourth, there is little evidence in this brief history that tax cuts, in and of themselves, sustainably increase GDP growth. This echoes Friedman (again) that government debt takes productive dollars out of the economy just as surely as government taxation.

Is this too simplistic? It is simplistic—monetary policy and the myriad other exogenous events ignored here must have some causal weight, and the eight-year smoothing window probably hides significant details. Yet the four observations above, placed into evidence, strongly support the conjecture that real long-term per-capita growth in federal spending, measured against corresponding GDP growth, is the most essential component of fiscal health.

Immodest Proposals

The clearest existential threat to the United States now or in the foreseeable future is the threat of fiscal collapse. Neither terrorism, nor the drug trade, nor China’s ascendancy, nor climate change can destroy the republic as surely as debt that can’t be paid.

Contemporary politics deflect attention from the existential issue: our long-term growth rates have been upside down, and there is no tax scheme that can durably compensate for this.

So rather than suffer the morality plays about marginal tax code changes, perhaps we can find common ground on the two fundamental issues: appropriate public policies to increase GDP growth, and the proper long-term growth rate of public spending.

On the first matter, history is instructive. Prosperity requires little more than "peace, easy taxes, and a tolerable administration of justice." Surely a consensus can be built around fair and stable tax rates, a level playing field in the private sector, reasonable and predictable regulatory and trade rules, a sound dollar, market-based allocation of resources, and peace?

It is the second matter that will require rare candor and a good deal of unpleasantness. If a return to 2% real long-term per-capita GDP growth can be effected, it seems to me that the correct real per-capita growth rate for public spending is close to 1%—i.e., positive growth, but safely below GDP growth—with the Clinton years being the model. Yet even this seemingly modest target will necessitate contentious entitlement reforms.

More disturbingly, many political actors now advocate dramatic permanent increases in federal spending, and some have proposed correspondingly dramatic tax increases. In their accounting, the Clinton years comprise policy failures. Such proposals are fundamentally dishonest for the reasons argued above—the long-term cost of accelerated spending is decelerated GDP, sapping tax receipts and driving deficits even higher. I don’t see anyone in the public sphere credibly addressing the sustainability of these proposals, nor looking at successful models for radical change. It seems to me that the real policy failures are those which invite a fiscal cave-in.

We quibble about position when it's velocity that determines our future. The historical data tell us that fiscal management is fundamentally about the management of growth—and that taming relative federal spending growth will steer us away from the looming crisis.